Facebook Loan Ads: How to Generate Quality Leads for Financial Services

Advertising loan services on Facebook is one of the most effective ways to reach potential customers in the financial sector, but it is also subject to many strict policy constraints. With Facebook applying the Special ad category for credit products, advertisers can no longer use detailed targeting as before. This causes many campaigns to face difficulties, with rising costs while lead quality declines. So how can you both comply with Facebook policies and generate quality leads for loan services?

In this article, BlackHatWorld will analyze the core principles and practical strategies to help loan ads on Facebook remain effective and sustainably profitable. We also guide you on how to use ad testing tools to find potential customers on Facebook for loan businesses.

Barriers that Loan Businesses face when running Facebook ads

The hot news that most advertisers are discussing is the series of new restrictions from Meta. These changes are being aggressively implemented and directly target sectors considered sensitive, including health, healthcare, finance, and politics.

For loan businesses, this means that advertising is no longer as “free” as before. Meta’s official goal is to enhance user privacy and ensure compliance with global legal regulations. In reality, many advertisers believe that past lawsuits related to personal data are the root cause of these drastic changes. Whatever the reason, the consequence is clear: financial brands are operating in a “playground” that is more tightly controlled than ever.

Data collection and usage processes become more stringent

In essence, the new restrictions have completely changed how loan businesses collect and use advertising data across the Meta ecosystem. The process is not just slightly harder, but is becoming many times more rigorous. If previously you could rely heavily on data to optimize campaigns, currently, those strategies risk no longer being effective. We have seen many financial advertisers having to pause or “rebuild” their entire funnels simply because data is no longer as accurate as before.

Restricted data and conversion tracking

One of the biggest impacts is the limited functionality of core tools like Meta Pixel and Conversions API, especially for bottom-funnel events such as loan applications, consulting form submissions, or completed profiles. This leads to a series of serious consequences. Advertisers can no longer collect detailed data on user behavior, cannot accurately track conversions, and are almost in the dark regarding ad effectiveness measurement. For example, a consumer loan company might know the number of clicks, but it is unclear exactly how many people actually qualified for the loan and submitted a valid profile.

Targeting must be broader

Another change causing “headaches” for many loan businesses is that Meta forces campaigns to use broad targeting. Personally, we do not view this as a disaster because Meta itself increasingly prioritizes algorithms and broad audiences. However, for the finance industry, this still brings many risks.

When the ability to deeply personalize is not available, ads may become less relevant to viewers. Engagement and conversion rates are therefore likely to decrease. For example, instead of accurately targeting people with business loan needs, ads may be displayed to those who are ineligible or have no real demand.

Risk of misclassified ad categories

This is an extremely serious issue that many advertisers often underestimate. Brands situated on the “borderline” between sensitive categories, such as skincare, supplements, or fitness, are very likely to be misclassified by Meta into the finance or health groups.

When that happens, businesses will face heavy restrictions similar to the loan industry, even if the product does not entirely belong to that category. Notably, Meta processes misclassification cases very slowly, causing a long-term impact on campaigns. The consequences can include throttled distribution, restricted data, and the entire marketing strategy being disrupted. In the context where 70 to 80 percent of eCommerce budgets are still spent on Meta, this impact is immense.

The Financial Business groups are most heavily affected

Not only traditional loan companies, but a range of other financial models are also facing direct impacts. These include short-term loan services, mortgage brokers, stock and cryptocurrency investment apps, credit repair services, and life insurance targeting specific demographics. With just a small policy change, the entire lead system and revenue of these models can be affected immediately.

Tips for creating High Quality Warm Audiences for Facebook Loan Ads

One of the most effective Facebook ad strategies for warm audiences that we are currently applying is using two separate ad accounts.

- The first account is an educational account, which is not labeled as a financial service. This account is used to run ads for webinars, ebooks, or pure financial knowledge content. Because it is purely educational, Meta allows for more detailed targeting.

- The second account is a financial account, which is fully labeled and used to remarket to people who have gone through the educational phase.

A practical example we implemented is a Roth IRA campaign for children. On the educational account, we targeted parents in the top 5 to 10% household income bracket in the US. The ad content revolved only around financial management knowledge and the long-term benefits of saving for children, without selling any services

After users register or join a webinar, we share the pixel and audience files with the financial ad account. At this point, the ads begin introducing investment services and calling for consultation bookings. In this stage, we answer “Yes” to questions related to financial service promotion to ensure policy compliance. We recommend enabling phone number verification in the lead form to obtain the highest quality data.

This is a legal loophole, and at the time of our implementation, financial education was still allowed by Meta to operate in this manner. If you only educate users, you do not need to apply a label. However, when selling products or services, labeling is mandatory.

Handling Rejected Status for Loan Ads on Facebook

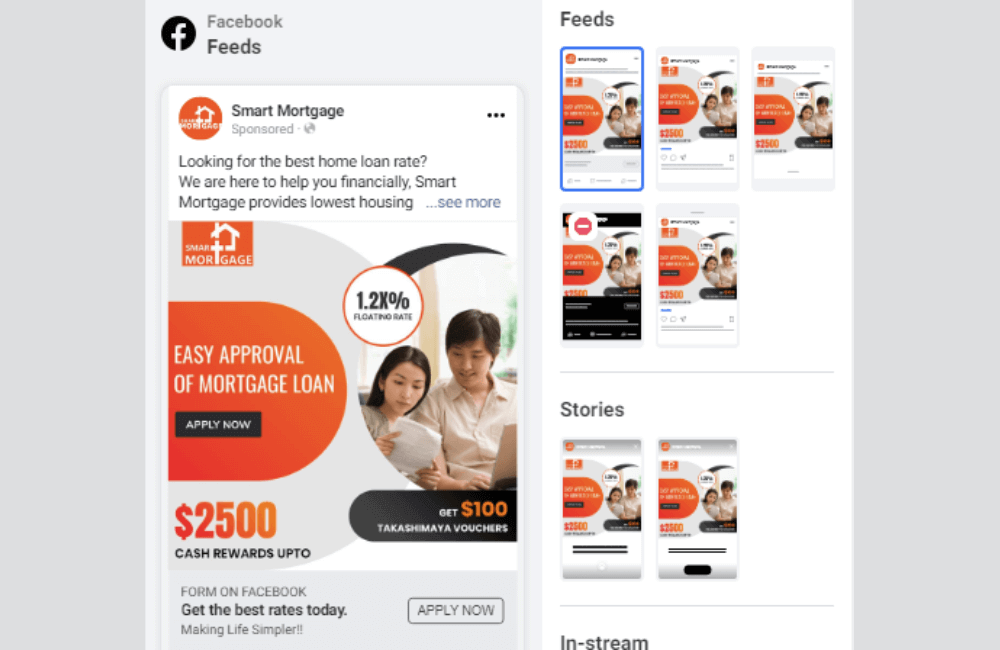

Similar to financial service ads on Facebook, advertising for loans and financial services on Facebook has never been an “easy game.” Just one careless word, an unclear disclaimer, or a sensitive number appearing in the creative can cause your ad to be rejected immediately.

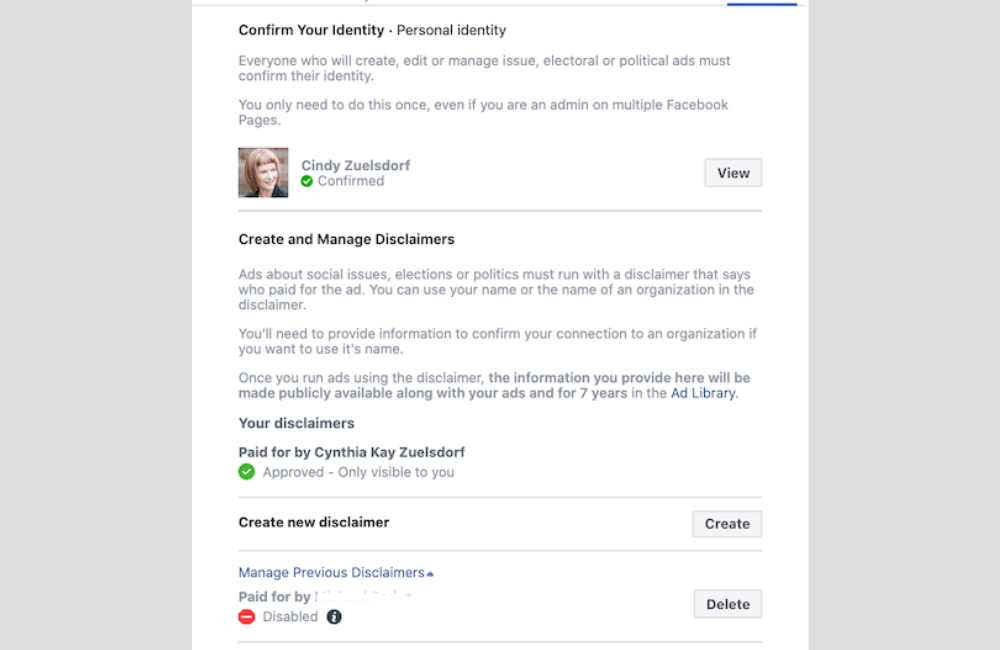

SEC compliance

In addition to complying with Meta policies, financial advertisers in the US are also required to follow SEC regulations, which are known to be extremely strict. We have spent significant time researching Rule 206(4)-1 (Marketing Rule) under the Investment Advisers Act to ensure all advertisements stay within the safe zone.

After working directly with financial experts and SEC specialists, we have streamlined these into a core set of principles, strict enough for compliance yet flexible for marketing. The most important principles include:

- Do not make any false or misleading statements

- Must clearly disclose if using actors or paid individuals

- Do not cherry-pick results, only selecting good cases to show off

- Always include a clear, visible, and easy-to-understand disclaimer

- Be transparent about risks, costs, and related assumptions

By violating just one of the above points, ads are very likely to be rejected by Meta or the account may face restricted distribution.

Disclaimer và nội dung quảng cáo

In our campaigns, we often use UGC, but this comes with a mandatory disclaimer system. Some examples that we always include in ad content or videos include:

- “This is a paid actor.”

- “Past performance does not guarantee future results.”

- “Results may vary from case to case.”

Conversely, some phrases must absolutely not appear in financial ads:

- “Guaranteed profit”

- “You will earn X million”

- “Certain income”

If you use these phrases, Meta will almost certainly reject the ad and even assess risk at the account level. Our strategy is to start with an extremely safe message, then gradually test the permitted boundaries, and always maintain an educational tone instead of direct selling. A very typical example:

- Wrong: “Your child will inherit millions of dollars tax-free.”

- Right: “Can help your child’s retirement account grow long-term thanks to tax-free compound interest.”

The difference lies in the phrasing. One side is commitment and exaggeration, while the other side provides educational information.

Direct Insights from Meta that advertisers need to remember

During the implementation process, we work extensively with Meta Support and have drawn important lessons.

- The first lesson is to limit the use of specific numbers. Meta’s AI system is very sensitive to data, and just one number related to profit or finance can cause an ad to be automatically flagged.

- The second lesson is that copy is the factor causing the most trouble, not images or videos. Therefore, every word needs to be carefully considered.

- The third lesson is that financial ads are very easy for users to report because they suspect fraud. To limit this, we often use phrases like “for informational purposes only” and avoid any promissory language.

- The fourth lesson is that you should edit rejected ads instead of creating new ones. Sometimes, just changing a single word can get the ad approved again.

After mastering the compliance foundation, we deploy ads in Ads Manager with a high level of caution. In the first few weeks, the messaging is always kept at a “vanilla” level, with no numbers, no big claims, and no promises. Once the account has established trust, we gradually increase the clarity of the message to determine Meta’s acceptance threshold. This approach helps scale safely without getting the account disabled.

Frequently asked questions

Yes. If you clearly understand special ad categories, strictly comply with policies, and build an educational funnel before selling, Facebook remains a stable and quality channel for generating loan leads.

Focus on educational content, use Higher Intent lead forms, and combine with phone number verification and remarketing at the right time. Lead quality always comes from how you filter, not just from the budget.

💬 Contact now for free consultation from BHW!

- Website: https://vi.blackhatworld.io/

- Telegram: @bhw_agency

- Whatsapp: +84819001811

- Wechat: bhwagency

- Email: [email protected]

This article is also available in other languages: